Get Access to a Customizable PTO Policy

Now, more than ever, it’s essential that employers have effective PTO policies in place. Employees who aren’t getting the rest they need get burnt out, and long-term, employers risk facing staff shortages when too many employees take their vacations all at once.

Whether your company has an accrual policy, banked PTO or unlimited PTO, it’s critical that a formal time off or paid leave policy is in place so employees are aware of the rules and expectations. Too many accrued PTO days can put companies in a precarious position financially. And, if PTO is mismanaged, employers can be out of compliance with state laws. The good news is, we’ve put together a guide of everything employers need to know.

What is Paid Time Off or PTO?

Paid time off (PTO) refers to the allocation of time employees can take off work and still be paid regular wages. PTO is the combined allocation that can be used for vacation time, sick time, bereavement or personal time, and is provided as an employee benefit, usually for full-time workers. PTO is often accrued over each pay period, but may also be assigned at the beginning of employment.

Because PTO combines all of an employees’ time off and offers flexibility for them to use it for vacation, sickness or personal days, it’s important to have a formal PTO policy that does the following:

- Allows employers to manage unscheduled absences

- Serves as a helpful benefit for applicants and current employees

- Gives employees clear direction on how much PTO is offered, when it starts, how it is accrued and how much can be used at one time

- Provides terms for special circumstances (unpaid time off)

Are Employers Required to Offer PTO to Full-Time Workers?

Most employers are not required by federal law to offer PTO. Some small to medium sized businesses have undocumented paid time off (PTO) policies simply because they’re not sure where to start.

Do Employers Have to Provide PTO to Contractors or Part-Time Employees?

Under the Fair Labor Standards Act (FLSA), employers aren’t required to provide paid leave to part-time employees, but they can’t refuse to pay exempt employees for absence due to illness or disability unless they have a documented plan for paid time off specific to these absences, and those exempt employees are either not eligible yet or have used up their PTO benefits under the plan. Some federal contract work requires paid time off.

What Are the Laws Related to PTO policies?

Employers aren’t required by law to provide paid vacation leave. However, specific states, cities and federal contractors must, by law, provide paid sick leave. As an employer, it’s important to acknowledge each state’s laws for sick leave, family leave, and PTO payout rules. PTO payout laws are for employees who have accrued time off and then leave a company before it can be used. A clearly defined paid time off policy clarifies any confusion about this requirement.

PTO Policies Can Help You Remain Compliant

Establishing clear and compliant employee policies is essential to avoiding costly lawsuits. Businesses should consistently review their employee handbooks and individual policies to ensure they are updated to reflect the latest government regulations.

What Are the Benefits of a PTO Policy?

A PTO policy benefits both the employer and employees. Benefits include:

Attracts and retains talent: A comprehensive PTO package provides a competitive advantage in the job market. It serves as an appealing benefit for potential hires and helps in retaining current employees.

Boosts employee well-being: A well-structured PTO policy allows employees to take necessary breaks and time off, which promotes a healthy work-life balance and boosts employee morale. According to an extensive survey by Calendar Labs, conducted in 2023, employees who were the happiest at work took an average of 15 PTO days in the previous year.

Increases productivity: Employees who have the opportunity to rest and recharge tend to be more focused and productive when they return to work.

Ensures adequate coverage: With a formal PTO policy in place, employers can better manage and anticipate unscheduled absences, minimizing workflow disruptions.

Clarifies expectations: A clear PTO policy provides employees with specific guidelines on how much time off they are entitled to, when it starts, how it is accrued and how it can be used. This reduces confusion and ensures everyone is on the same page.

What Are the Common Challenges Businesses Face when Managing PTO?

Many of the challenges businesses face when managing PTO can be solved with a PTO policy. For example, without a clear policy, PTO may be applied inconsistently across employees, leading to perceptions of unfairness and dissatisfaction. Documented guidelines ensure employees understand how PTO is accrued and used, promoting fairness and transparency.

Other common challenges include:

- Last-minute absences

- Employee burnout

- Difficulty tracking accrual and usage

Surprisingly, employers also struggle with encouraging employees to utilize their PTO. In fact, a May 2024 Harris Poll found 78% of employees don’t use the maximum amount of PTO afforded by their employers. Pressure to be available and heavy workloads were the top two reasons cited for not taking time off, both of which amount to dissatisfied and burnt out employees. To address this challenge, employers should focus on creating a supportive culture around PTO usage.

What Are the Key Components of an Effective PTO Policy?

If you’re starting from scratch, or if you need to update your existing policy, here are some of the key components. We’ve provided suggestions, but you can adjust hours and terminology to fit your situation.

What to Consider When Creating a PTO Policy (Example)

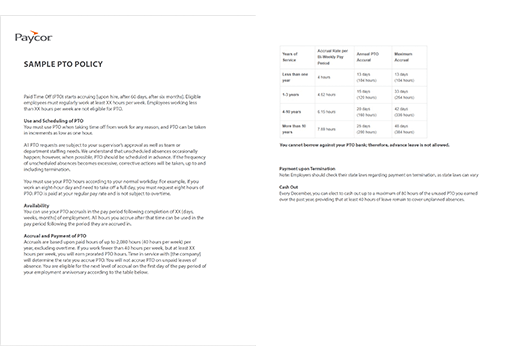

PTO starts accruing [upon hire, after 60 days, after six months]. Eligible employees must regularly work at least XX hours per week. Employees working less than XX hours per week are not eligible for PTO.

Use and Scheduling of PTO

You must use PTO when taking time off from work for any reason, and PTO can be taken in increments as low as one hour.

All PTO requests are subject to your supervisor’s approval as well as team or department staffing needs. We understand that unscheduled absences occasionally happen. However, when possible, PTO should be scheduled with advance notice. If the frequency of unscheduled absences becomes excessive, corrective actions will be taken, up to and including termination.

You must use your PTO hours according to your normal workday. For example, if you work an eight-hour day and need to take off a full day, you must request eight hours of PTO. PTO is paid at your regular pay rate and is not subject to overtime.

Availability

You can use your PTO accruals in the pay period following completion of XX [days, weeks, months] of employment. All hours you accrue after that time can be used in the pay period following the period they are accrued in.

Accrual and Payment of PTO

Accruals are based upon paid hours of up to 2,080 hours (40 hours per week) per year, excluding overtime. If you work fewer than 40 hours per week, but at least XX hours per week, you will earn prorated PTO hours. Time in service with [the company] will determine the rate at which you accrue PTO. You will not accrue PTO on unpaid leaves of absence. You are eligible for the next level of accrual on the first day of the pay period of your employment anniversary according to the table below.

| Years of Service | Accrual Rate per Bi-Weekly Pay Period |

Annual PTO Accrual | Maximum Accrual |

| Less than one year | 4 hours | 13 days (104 hours) |

13 days (104 hours) |

| 1-3 years | 4.62 hours | 15 days (120 hours) |

33 days (264 hours) |

| 4-10 years | 6.15 hours | 20 days (160 hours) |

42 days (336 hours) |

| More than 10 years | 7.69 hours | 25 days (200 hours) |

48 days (384 hours) |

You cannot borrow against your PTO bank, meaning advance leave is not allowed.

Payment Upon Termination

In accordance with [state – Note that if you have locations in multiple states, this section must be carefully reviewed for accuracy] law, after [XX days, weeks, months] of employment, you will be paid for all PTO hours you accumulated but did not use if you resign, retire or otherwise separate from the company.

Cash Out

Every December, you can elect to cash out up to a maximum of 80 hours of the unused PTO you earned over the past year, providing that at least 40 hours of leave remain to cover unplanned absences.

How to Pick a PTO Policy for Your Business

There are a few different types of PTO methods you can adopt for your business:

- Accrued PTO: Builds up over time

- Banked PTO: Distributed all at once

- Unlimited PTO: Unlimited amount of hours and days for each employee

When choosing a PTO policy for your business, it’s important to consider your business’ needs during holidays and peak times. For example, it probably doesn’t make sense for a company with a high production requirement to have an unlimited PTO policy.

Also, consider company culture and what your competitors offer. For example, many creative fields embrace the unlimited PTO model. If that’s the case in your market, failing to follow suit could make it difficult to compete for top talent.

Best Practices for Implementing a PTO Policy

Follow these best practices when drafting and implementing PTO guidelines:

- Ensure the PTO policy is detailed and easy to understand. Include specifics on how PTO is accrued, the process for time off requests and any restrictions or special circumstances.

- If this is a new or updated policy, ensure its rollout is communicated. Host a meeting to discuss the policy and answer any questions.

- Add the policy to the employee handbook and require employees to sign an addendum noting their receipt of the policy.

- Implement an automated system to manage PTO requests, accruals and balances.

Paycor Can Help

With Paycor’s automated time and attendance system, employees can request time off, see how much PTO they’ve accrued and easily access employer PTO policies. But that’s just the tip of the iceberg. Employees can also clock in and out, manage their schedules and view pay stubs, all while on the go. Want to learn more? Connect with a Paycor consultant.