The pandemic is putting a big strain on everyone, maybe most of all your team, and you want to do everything you can to help.

In a national emergency, employers have the freedom to offer unlimited tax-free financial assistance to employees who need it, with minimal administrative burdens. These disaster payments will be exempt from both federal income and employment taxes.

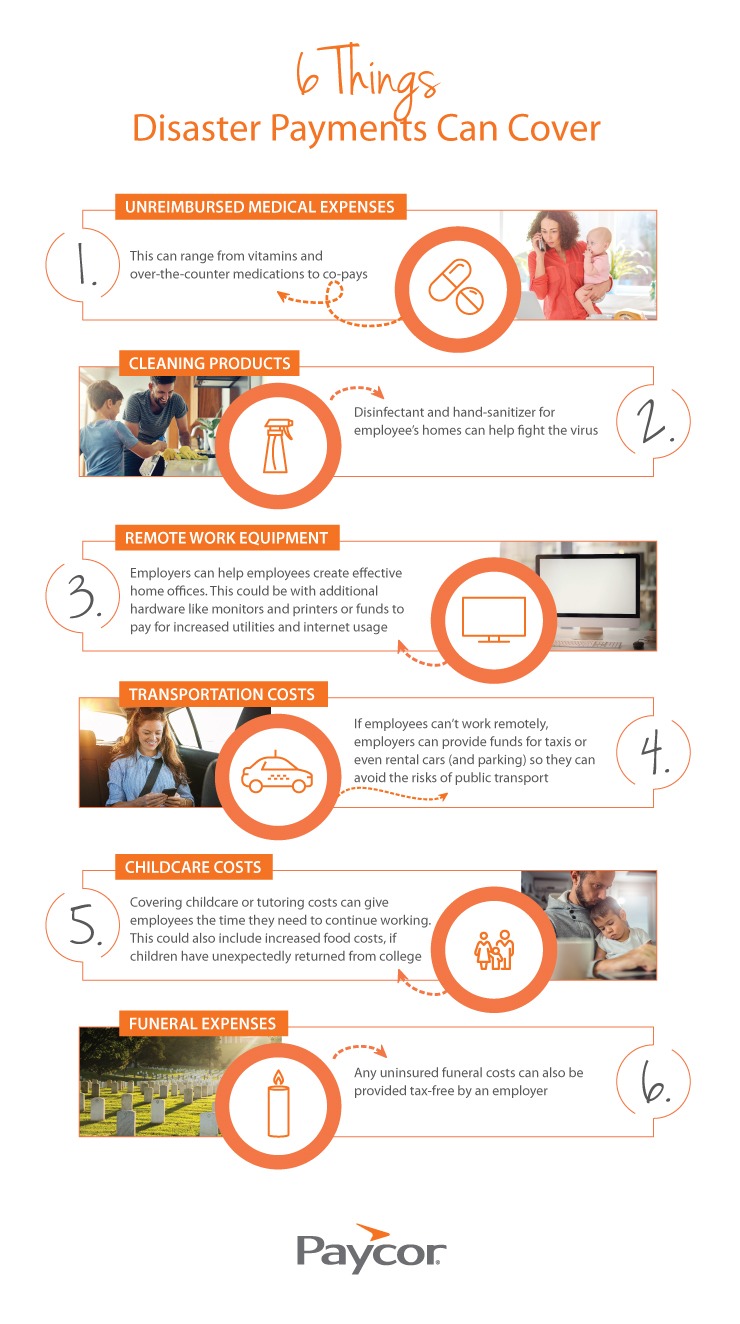

What Disaster Payments Cover

Disaster payment to affected employees can cover a broad range of “personal, family, living or funeral expenses (not covered by insurance)”. These may include:

- Unreimbursed Medical Expenses

This can range from vitamins and over-the-counter medications to co-pays. - Cleaning Products

Disinfectant and hand-sanitizer for employee’s homes can help fight the virus. - Remote Work Equipment

Employers can help employees create effective home offices. This could be with additional hardware like monitors and printers or funds to pay for increased utilities and internet usage. - Transportation Costs

If employees can’t work remotely, employers can provide funds for taxis or even rental cars (and parking) so they can avoid the risks of public transport. - Childcare Costs

Covering childcare or tutoring costs can give employees the time they need to continue working. This could also include increased food costs, if children have unexpectedly returned from college. - Funeral expenses

Any uninsured funeral costs can also be provided tax-free by an employer.

What disaster payments to employees can’t be used for:

- Sick Pay or Any other Leave

Disaster payments to employee do not cover any wage replacement like sick pay. This is still subject to income and payroll tax withholding and reporting. Disaster payment cannot be proportional to salaries. - Non-essential Products or Services

The payments can’t be used for any non-essential, especially luxury or decorative, items.

How to Distribute Disaster Payments to Employees

Once the President invokes the Robert T. Stafford Disaster Relief and Emergency Assistance Act (the “Stafford Act”), which President Trump did on March 13, employers are free to offer employees these disaster payments, with a minimum of red tape.

The relevant section of the I.R.S. code, Section 139, is generous and uncomplicated compared to most employee benefit provision legislation. There is no discrimination testing and employees don’t need to collect receipts as long as the payments are reasonable.

SMB leaders just need to decide how best to distribute the funds. The smaller the company, the simpler it may be. It could be limited to one-off payments to those you know are in need. However, it’s still a good idea to have a written policy and application procedure.

How to Create a Written Employee Disaster Payment Plan

Though not explicitly required, a written plan helps employees understand how and why disaster payments will be distributed (and can been shown to the I.R.S. if required).

Here’s what an Employee Disaster Payment policy should include:

- An Introduction to The Program

Here’s where a company can explain that the declaration of a national emergency gives you more freedom to help employees out. You can also set out what your company hopes to achieve—supporting your valued employees in a crisis. - Who is Administering the Policy

This could be the leader of the company or a small committee of employees chosen to ensure that all payments are distributed fairly. - What Expenses Will Be Covered

Choose under what circumstances you will offer disaster payments. These rules can be as narrow or broad as you choose—remember, this is an optional program. - Any Financial Limits

The I.R.S. do not set any limits on deductible payments (either individual or total) but your company may wish to set out internal limits. - The Application Process

This is crucial—set out how to apply (and where employees can find an application form), who can apply and for what. - How Payment Will Work

Be clear how employees will receive funds if their applications are successful.

Paycor is Here for You

For expert advice and support during this public health emergency, visit Paycor’s Coronavirus Support Center.

Paycor builds HR software for leaders of medium & small business. For 30 years, we’ve been listening to and partnering with leaders, so we know what they need: HCM technology that saves time, powerful analytics and expert HR advice to help them solve problems and achieve their goals.

Paycor is not a legal, tax, benefit, accounting or investment advisor. All communication from Paycor should be confirmed by your company’s legal, tax, benefit, accounting or investment advisor before making any decisions.