A pay stub is part of a paycheck which details the hours worked, taxes paid and wages earned for a specific pay period and year-to-date payroll. Employees receive either electronic or printed payroll pay stubs, but with the rise of direct deposit, electronic pay stubs are becoming more prevalent.

For employers, pay stubs prove their business is paying their employees as promised. It is also a record confirming required taxes and fees have been deducted. For employees, pay stubs can be reviewed to ensure accurate payments and correct deductions.

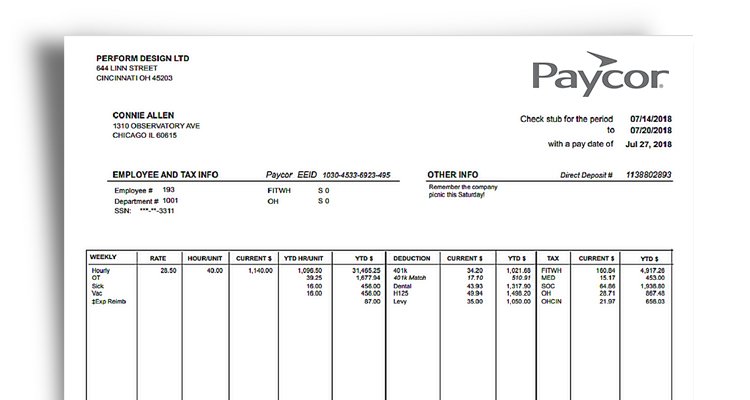

Here’s a list of the parts of a pay stub followed by a pay stub example:

- Employee name

- Pay period and date

- Hours worked

- Gross pay

- Deductions

- Voluntary contributions, e.g. health insurance and 401K

- Taxes (federal income tax, FICA, and state and local income taxes where applicable)

- Employer contributions (FUTA, SUTA, FICA, employee benefits)

- Direct deposit information

- Net pay

Learn more about issuing pay and pay periods here.

Previous:

Gross vs. Net Pay