It’s no secret, healthcare insurance plans don’t cover everything. And it’s enough of a problem to cause real concern. In fact, KFF polling shows 25% of adults say they have skipped or postponed needed health care due to cost in the 12 months prior to the January-February 2024 poll. 48% of insured adults noted worry about affording their monthly health insurance premiums.

Unfortunately, the cost of healthcare isn’t getting any cheaper. PwC projects an 8% year-on-year medical cost trend in 2025 for the Group market, representing its highest level in 13 years. Fortunately, there is something employers can do. As employees look for ways to prepare for the unexpected, offering HSAs and FSAs might be the best way to help. For more insights, check out a recent Paycor webinar on the hidden secrets of HSAs and FSAs.

What are HSAs and FSAs?

Flexible spending accounts (FSA) and healthcare saving accounts (HSA) are pre-tax benefits that aid employees in saving and paying for qualifying medical costs. FSAs are typically funded solely by the employee and funds must be used by December 31 (or a designated date). HSAs can be funded by employees, employers, or both and are carried over year after year.

These benefits can be a competitive advantage for employers as employees favor those who help them prepare for expected and unexpected health costs. It pays to care about your employees’ financial wellbeing.

How are HSAs used?

An HSA is health savings account owned by an individual. Employees deduct a portion of their paycheck, before taxes, and the money is set aside for medical expenses, or investments (if unused) to help prepare for retirement.

The average couple spends $315,000 in healthcare costs during retirement, according to the Fidelity Retiree Health Care Cost Estimate. This makes HSAs, which are portable and can move with employees from job to job, particularly valuable.

Employers can also contribute tax-free to their employees’ HSAs. Employees must have a high-deductible health plan (HDHP) in order to contribute. The interest earned is tax-free, and they offer tax-free withdrawals for qualified medical expenses.

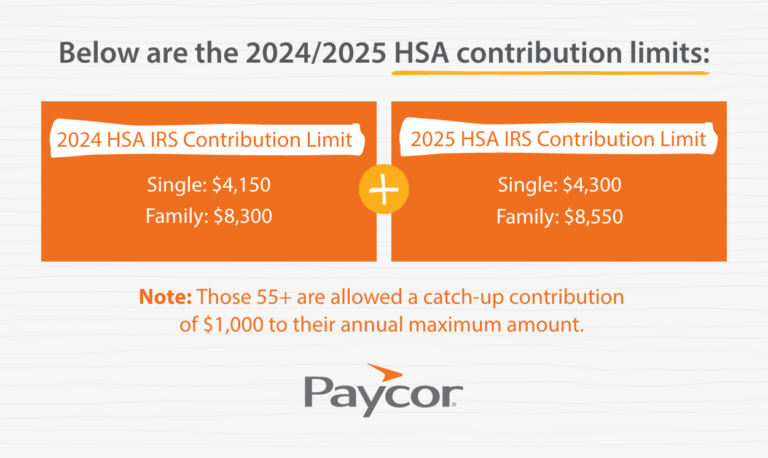

Below are the 2024/2025 HSA contribution limits:

Note: Those 55+ are allowed a catch-up contribution of $1,000 to their annual maximum amount.

How are FSAs used?

A Health Care FSA (HCFSA) is a smart, simple way to help employees save on medical, dental and vision expenses. Employees choose the amount they would like to contribute to cover out-of-pocket healthcare expenses at the beginning of the year and equal deductions are made throughout the year. These expenses can include:

- Copays

- Prescriptions

- Vision

- Dental expenses not covered by insurance

Employees can contribute up to $3,200 via payroll deductions during the 2024 plan year, which employers may match. Amounts contributed are pre-tax.

Although this article compares HCFSAs to HSAs, there are other types of FSAs:

A Limited-Purpose FSA can be used to pay for eligible dental and vision expenses, allowing employees to save HSA funds for other medical expenses. The 2024 contribution is $3,200 per employee.2,500 for married individuals filing separately) pre-tax dollars annually to pay for eligible dependent care expenses.

A Dependent Care FSA is a great way to help employees take care of those who depend on them. Dependent care plans give employees the option to contribute up to $5,000 ($2,500 for married individuals filing separately) pre-tax annually to pay for eligible dependent care expenses.

Curious about the difference between HRAs and HSAs? Get the facts in this article: HRA vs HSA: Benefits, Drawbacks, and Best Uses

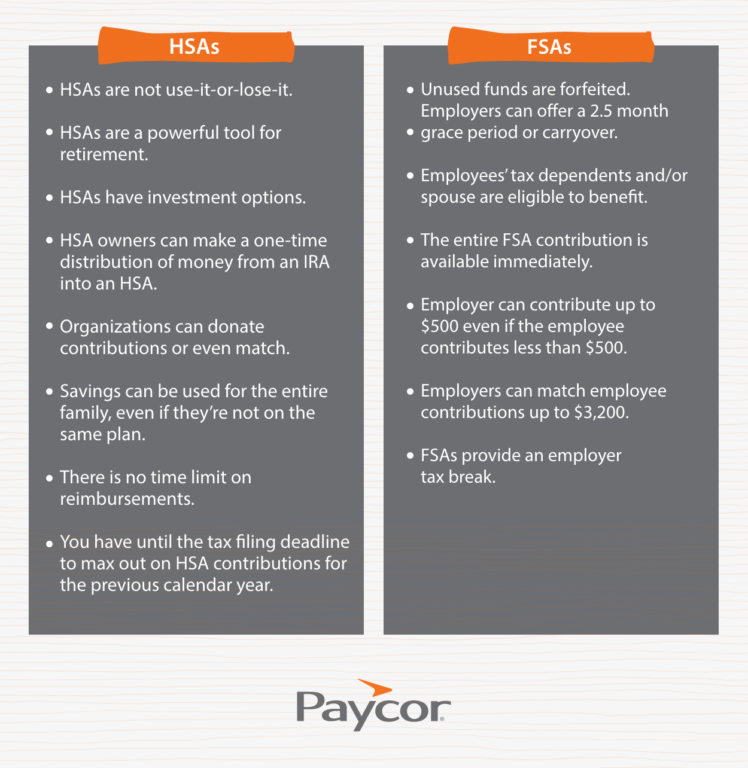

What’s the difference between an HSA and an FSA?

HSA vs FSA: Key differences

An HSA is owned by the employee and can only be opened and contributed to if an employee is part of a high-deductible health insurance plan. Additionally, an employee can only spend what is in an HSA account, but the amount follows an employee and/or carries over from year to year.

FSAs are owned by the employer, and employees are considered participants in the plan. However, funds in an FSA must be exhausted within a plan year and do not follow employees and cannot be rolled over (in entirety) into the next year.

Per IRS rules, you can’t contribute to an HSA and FSA in the same plan year. However, Limited-Purpose FSAs (LPFSA) and Dependent Care FSAs can be paired with an HSA.

Therefore, offering an LPFSA or Dependent Care FSA alongside an HSA helps your employees further reduce taxes.

Little-known facts about HSAs and FSAs

- There is an FSA store and an HSA store. Items are delivered straight to your door, and everything is HSA/FSA eligible. This is a good benefit for those with FSAs, who can purchase items in bulk near the end of the year.

- There are two options employers can offer outside of use it or lose it for FSAs:

- Grace period for up to two and a half months after the plan year end. Help your employees strategically plan how to use the money and exhaust funds so they don’t go to waste.

- Some employers can offer carryover. The IRS maximum is $640 that can be carried into the next plan year.

- An HSA can help employees plan for retirement. Contributions can be made every year and they won’t disappear. HSA funds can also be invested for tax-free growth through mutual funds, stocks, etc. Once a person turns 65, they can use those funds for non-medical expenses, and will not incur a penalty, just tax on the income.

- Although with HSA accounts employees can only use what is contributed and full annual amounts are not available immediately like with FSAs, some providers allow for accelerated funding which helps with expenses upfront.

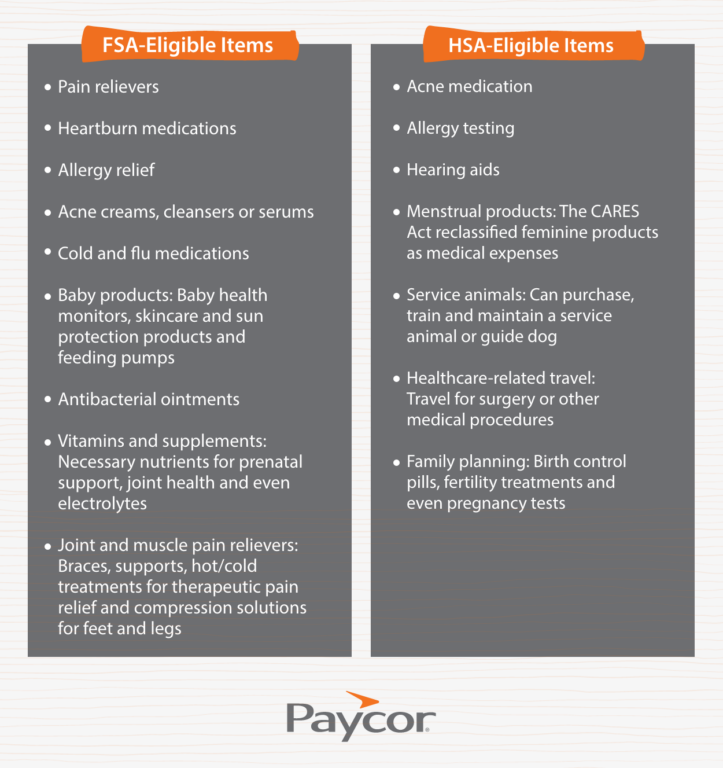

- The Coronavirus Aid, Relief and Economic Security (CARES) Act made a number of over-the-counter items eligible for HSA and FSA spending.

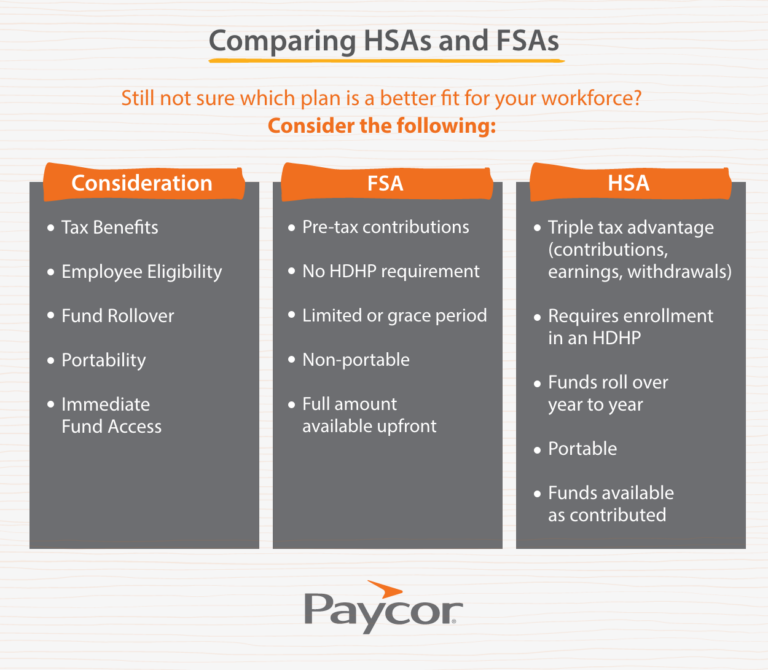

Comparing HSAs and FSAs

Still not sure which plan is a better fit for your workforce? Consider the following:

How Paycor helps

Paycor builds HR software to empower leaders. Our technology comes with personalized support from HR experts, who ensure our product is always up to date with the latest information about HSA and FSA limits. Learn more about our benefits administration software by taking a product tour.

Paycor’s human capital management (HCM) platform modernizes every aspect of people management, from recruiting, onboarding and payroll to career development and retention, but what really sets us apart is our focus on leaders.

For more than 30 years we’ve been listening to and partnering with leaders, so we know what they need: a unified HR platform, easy integration with third-party apps, powerful analytics, talent development software and configurable technology that supports specific industry needs. That’s why more than 30,000 customers trust Paycor to help them solve problems and achieve their goals.

Previous:

Pay Stub ExampleNext:

SUTA Tax