Discover how an HR compliance checklist can help leaders

HR leaders have a lot on their plates. From recruiting to payroll to interfacing with insurance providers, there’s always something to do. And on top of everything else, you always have to keep up with the most intricate part of HR administration: compliance.

To make things even more complex, the laws are always changing. It’s HR’s job to track those changes, update company systems, and implement new policies accordingly. Staying compliant helps you avoid legal trouble and steep fines. What’s more, it protects your business’s reputation, which has a major impact on company culture.

How do you stay compliant when the goalposts are always moving? The answer is simple: use an HR compliance checklist.

Using an HR Compliance Checklist

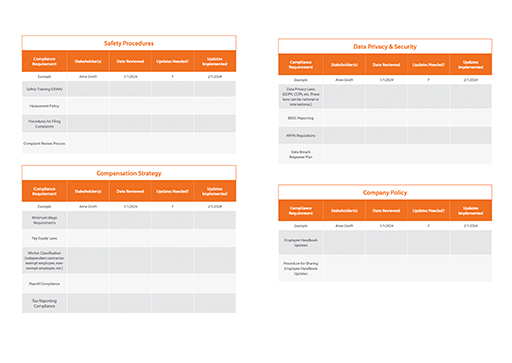

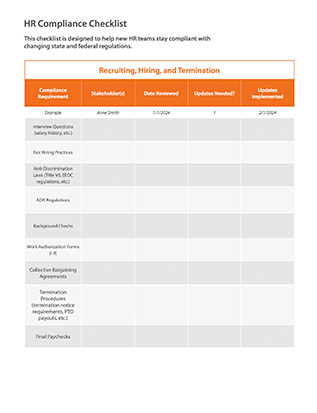

A compliance checklist empowers HR to keep track of all the major compliance issues that could affect the company. Start with our template to get a bird’s-eye view of the most important employment laws. From there, you can fill in additional relevant details, like state-wide or industry-specific laws that apply to you.

After you tailor the checklist to meet your company’s needs, use it to perform regular HR compliance audits. Depending on what you learn during each audit, you may have to update your company policies, employee handbook, or payroll process accordingly.

It can be difficult to understand compliance issues, even for seasoned business leaders. HR should develop a workflow to research new regulations, but make sure your legal team plays a role in the process before you implement major changes.

Why Compliance Matters

Business success starts with HR compliance. Even the best sales or marketing strategy will fall flat if you face issues in this area. For example, imagine you fail to pay non-exempt employees overtime, leading to a lawsuit. You might need to pay your team back for any missed overtime wages, in addition to fines and your own legal fees. This is a recipe for disaster. You risk alienating your workforce and your customer base, and your profit margin shrinks or disappears. With some careful planning, these problems are easy to avoid. HR can set the stage for financial success by creating a clear compliance workflow.

If you’re new to HR, compliance issues might be more wide-ranging than you think. There are regulations governing almost every aspect of this department’s work, such as:

- Interview questions

- Background checks

- Minimum wage

- Direct deposit

- Pay equity

- Benefits administration

- Paid and unpaid family leave

- Jury duty leave

- Lunch breaks

- Data breaches

- Workplace safety

- Workers’ compensation

- Termination procedures

- Final paychecks

- PTO payouts

- Unemployment insurance

And that’s just the beginning – employment law covers several other areas, too. Federal laws, like the Fair Labor Standards Act (FLSA) and Family and Medical Leave Act (FMLA), apply to businesses nationwide. You should also keep track of state and municipal laws, especially if you do business in multiple locations. Different laws may apply depending on your company size, industry, and number of employees vs. independent contractors.

Leaders should create a comprehensive compliance workflow, delegate tasks, and put important dates on the annual calendar. In larger companies, various HR professionals may need to collaborate closely. When you terminate an employee, for instance, some states require you to give them a formal separation notice. On top of that, there might be regulations around how and when HR should issue their final paycheck. To stay compliant, you’ll need an employee relations specialist and a payroll specialist to work together.

The Evolution of Employment Laws

The country’s laws reflect changing cultural norms and values. It’s easy to spot trends when you look at pay equity legislation or anti-discrimination laws like the CROWN Act. Over the past decade, more and more states have adopted laws to support a diverse workforce.

Trends are interesting, but they don’t predict the future. National politics change quickly and have a major impact on employment law. For example, a new presidential administration could have a significant impact on compliance requirements across the country. And some rules – like payroll compliance laws – change annually to reflect inflation and keep up with the tax code. HR leaders should stay abreast of these changes and be ready to implement updates on short notice.

Building a Culture of Compliance

An HR checklist is an important first step toward compliance, but it’s not the only one. Leaders can also incorporate compliance requirements into company culture. You might want to:

- Implement Training: Keep all employees, especially managers, informed about changing compliance requirements. Make sure your learning management system is up to the task!

- Seek Executive Buy-In: Everything’s a little easier with support from the C-suite. Leaders can give HR funding and set aside time for employee training. To access those resources, HR might need to demonstrate the ROI of compliance initiatives first.

- Conduct Internal HR Audits: Your HR compliance checklist should be a living document. Review it regularly – ideally once a quarter – and add new tasks if needed. This practice ensures that you won’t just keep up with changing laws, you’ll also stay informed of brand-new legislation.

Clear communication is essential here. Whether you’re updating your employee handbook, meeting with your legal team, or giving a report to the C-suite, the devil is in the details. Be as transparent as you can, and everyone at your company will understand why compliance is important. Better still, they’ll have a sense of their role in protecting your organization.

How Paycor Helps

Our Compliance Solutions help your team stay on top of changing regulations. Leaders can track and store critical documentation, classify jobs properly, forecast and control labor expenses, and design compliant benefits packages. From talent acquisition to payroll taxes to mandatory benefits and beyond, our tools streamline every aspect of HR.