In today’s job market, employers are constantly looking for new ways to attract and retain high performers. It can be especially hard to fill positions with non-standard working hours. In an attempt to fill in the gaps, some companies are offering shift differential pay.

If you’re struggling to schedule employees for nights, weekends, or any other non-standard time, this strategy could help. Shift differential policies can be very attractive to some of your employees, driving engagement and job satisfaction.

What Is Shift Differential Pay and How Is it Calculated?

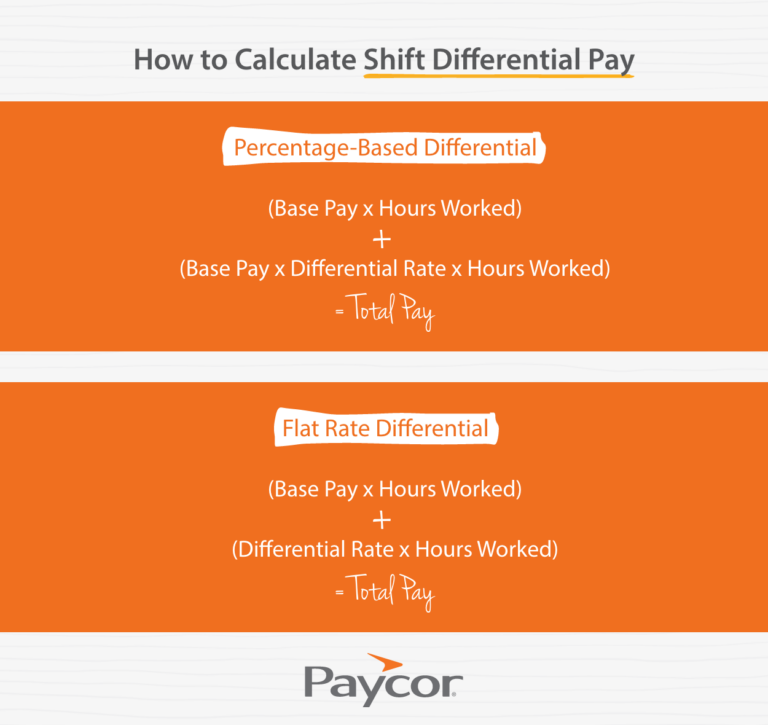

Shift differential pay is additional compensation for less desirable shifts. For example, you might pay employees at a higher rate to work overnight than during standard working hours. Shift differential pay is typically calculated as a percentage of an employee’s base rate, or as a flat dollar amount added to their regular pay.

For example, a company might offer:

- 10% additional pay for evening shifts (e.g., 3 pm – 11 pm)

- 15% additional pay for overnight shifts (e.g., 11 pm – 7 am)

- $2/hour additional pay for weekend shifts

HR should partner with Finance and use pay benchmarking to determine the exact amounts. Make sure to follow industry standards and adhere to your company policy, acting in alignment with your overall compensation strategy. It’s also important to review any overtime laws that apply to your business and make sure you stay compliant.

Why Do Employers Offer Shift Differential Pay?

In many industries, shift differential pay has huge benefits for both employers and workers. First and foremost, it helps attract talent and ensure all your essential shifts are fully staffed. It can also improve job satisfaction and retention for employees who work non-standard shifts.

Shift differential pay can even improve company culture. This practice accounts for the inconvenience of working night or weekend shifts for employees and their families. Rather than glossing over the issue, employers recognize how important it is for workers to take on undesirable shifts. As a result, shift workers feel more appreciated, motivated, and engaged.

From an employee perspective, shift differential pay can improve work/life balance. Shift work is challenging. It disrupts sleep schedules, social activities, and time with family. When those issues are offset by a higher pay rate, employees can work fewer hours overall without losing income.

Legal Considerations for Employers

Because HR is typically responsible for compliance, make sure you understand how shift differential policies can interact with pay regulations. These exact issues vary depending on your company’s location, size, industry, and similar factors. Before you implement a shift differential pay policy, check with your legal team about:

- Overtime Rules: Non-exempt employees are often eligible for overtime pay. Per the Fair Labor Standards Act (FLSA), shift differential pay must be included when calculating overtime hours.

- Discrimination Laws: Your shift differential policy should be fair and non-discriminatory. Make sure it includes a clear list of which employees are eligible for these shifts and a process for them to dispute unfair distribution of shift differential pay.

- Collective Bargaining Agreements: If you employ union workers, additional rules may apply. Carefully review any union contracts to stay compliant.

- Record-keeping: Shift differential pay has an impact on your payroll process and tax burden. Make sure you keep clear records of your policy, schedule, and other details.

Industries with Shift Differential Pay

Employers in any industry can offer shift differential pay, but it’s often unnecessary. Why incentivize an office worker to come in at night? But in some industries, shift differential pay is extremely common:

- Healthcare facilities

- Manufacturing

- Hospitality, especially hotels and entertainment venues

- Retail, especially during holiday seasons

- Transportation

- Call centers

- Security services

- Energy and utilities

These organizations operate long hours – some even stay open 24/7. In some cases, your team might even expect shift differential pay as the industry standard.

Designing a Shift Differential Policy

If you’re considering a shift differential policy, there are several things HR should keep in mind. To start with, review your labor costs to make sure it would fit into your budget. Labor forecasting can help you identify potential issues before they become major problems.

You should also review the needs of your specific workforce. Determine which shifts are the most challenging to staff, based on your past time and attendance records. Analyzing this data can help you decide how much more to offer for various shifts. For example, is it harder to fill shifts that run from 10 pm to 2 am, or from 2 am to 6 am? If there’s a significant difference, you could offer a 5% increase for one of those shifts and a 10% increase for the other.

After you codify the details of your shift differential policy, be sure to run it by your legal team. Once they approve it, you can add the policy to your employee handbook. HR should also share it with everyone on the team and have employees formally acknowledge receiving it. This step can help you avoid legal or compliance issues that might arise in the future.

Bear in mind that your policy may have to change over time. Laws are constantly changing, and you may need to adjust your budget accordingly. Your workforce’s needs will also change due to turnover, cultural shifts, or – for long-term employees – major life events. Stay aware of their needs, goals, and biggest motivators by conducting regular employee surveys.

How Paycor Helps

Paycor’s suite of HCM software empowers leaders to handle every aspect of people management. Whether you’re gaining insights from Paycor Analytics, managing schedules with Time and Attendance software, or collecting employee feedback with a Paycor Pulse Survey, these tools can take your HR processes to the next level. Connect with one of our representatives to learn how Paycor can help your business incorporate shift differential pay into your payroll process without missing a beat.