In today’s competitive job market, businesses are looking for new ways to attract, retain, and engage top talent. One current trend is the profit-sharing plan. This benefit fosters company culture, encouraging emotional buy-in from the whole team. With the right support from HR, profit-sharing plans can work wonders for productivity.

What Is a Profit-Sharing Plan?

A profit-sharing plan is a type of retirement plan allowing businesses to share a portion of their profits with employees. Unlike other models, profit-sharing ties these rewards to the company’s financial performance.

How Does a Profit-Sharing Plan Work?

Legally, profit-sharing plans offer a lot of flexibility. Employers can set them up with a wide variety of rules, depending on what works best for the company. However, it’s very important to have specific guidelines before implementing this benefit. When designing the plan, HR should keep a few details in mind:

- Businesses of any size can offer profit-sharing alone or in addition to other retirement plans.

- To stay compliant, you’ll need to file IRS Form 5500 every year.

- Only employers can contribute to profit-sharing accounts.

- If your profit-sharing plan includes salary deferral, it becomes a 401(k) plan.

- Contributions are discretionary. In other words, employers are not required to contribute every year.

- You can contribute whether or not your business makes a profit in that year.

- Employers must adhere to profit-sharing contributions limits. At most, you can contribute the lesser of these amounts per employee: 100% of employee salary, or $69,000 in 2024. The maximum dollar amount is subject to cost-of-living adjustments each year.

Deciding on Your Contribution Amount

As you’re designing your plan, be specific about the criteria for employee eligibility. For some businesses, this could be a compliance issue. For small businesses, for example, employees must complete at least 1,000 hours of work in the year preceding their plan entry date. Make sure your stated criteria are fair and transparent, and don’t discriminate against anyone on your team.

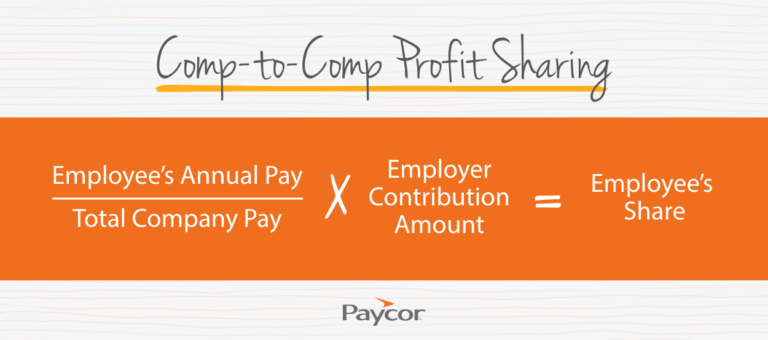

There are several ways to calculate your contribution amount for each employee. While the exact amount you contribute can change from year to year – and sometimes drop to $0 – the guidelines should remain the same. One common method to calculate contributions is the “comp-to-comp” model. Here’s how that works:

Profit-Sharing Plans vs. 401(k)s

Both profit-sharing and 401(k) plans are attractive retirement benefits, but they have some key differences:

| Profit-Sharing Plans | 401(k)s |

| Plans are only funded by employers.Contributions vary from year to year.The employer typically manages investments. | Employees contribute money.For most employees, contributions are consistent.Employees have more control over their investment choices. |

Many companies offer both profit-sharing plans and 401(k)s.

Pros and Cons of Profit-Sharing Plans

Profit-sharing plans can provide a major boost to employee motivation. When they have a personal stake in the success of your business, employees may be more productive, engaged, and loyal to the company. And when your company does well, profit-sharing plans will also increase morale.

However, this emotional investment is a double-edged sword. In lean years, employee morale might go down, which could increase voluntary turnover. Profit-sharing plans are also a significant administrative burden. Make sure your HR team has the tools they need to design and implement your plan correctly, or you’ll risk running into compliance issues.

How Paycor Helps

Paycor’s Benefits Administration software empowers leaders to offer a comprehensive benefits package. Our tools help you navigate open enrollment, communicate with employees, and stay compliant every step of the way. If you’re considering a profit-sharing plan, our broker partners can help you understand how it would fit in with the other benefits you offer. Connect with a representative today and learn how Paycor can support your long-term business goals.