Workers’ compensation is a safety net that protects both businesses and employees. Companies pay a monthly premium for workers’ comp insurance. Then, if an employee gets a work-related illness or injury, they’ll receive a payout from the insurance company. This protects the employee from lost wages if they can no longer work or gives money to their family in the event of their death. It also protects the company from expensive legal fees. If workers know they can depend on workers’ comp insurance, they’re less likely to sue for damages.

Workers’ comp is mandatory for most businesses. (Be sure to check which exact laws apply to your company, based on size, industry, and location.) Unfortunately, employees sometimes commit workers’ comp fraud to try and get an insurance payout without an illness or injury.

What is Workers’ Compensation Fraud?

Workers’ comp fraud comes in a few different forms. For example, an employee could fake an injury or an illness. They might lie to the business or even their doctor about the extent of their symptoms. In extreme cases, workers forge medical records or collaborate with a doctor who’s willing to do so for them.

In another type of workers’ compensation fraud, the uninjured employee works for one company while collecting workers comp benefits from another. This is essentially double-dipping – the employee claims they’re unable to work but continues to get a regular paycheck.

Workers aren’t the only ones who can commit this type of fraud. Employers can commit workers’ comp fraud by misclassifying employees or falsifying data. There might be penalties for doing this even by mistake.

How common is workers’ comp fraud? Experts disagree. Some estimate that up to 10% of all workers’ claims could be fraudulent (Sacks Law Group). Others put the number higher or lower. But even one fraudulent claim could be a significant problem for your business.

On the other hand, even the highest estimates agree that most workers’ comp claims are valid. Employers should approach these claims in good faith. Do your due diligence and investigate claims as necessary but know that this process has an impact on company culture. Even if an employee does commit fraud, HR should handle the situation with respect and professionalism.

How Workers’ Comp Fraud Affects a Company

Workers’ comp payouts can increase your insurance premiums. Every successful workers’ comp claim shows your insurance company that your business is at a higher risk. This claim could increase the risk of future claims, and your insurer will offset that risk by charging your company a higher rate.

HR should never dispute a valid claim, of course. But fraudulent claims can have a hugely negative impact on your company’s bottom line.

How to Recognize the Signs of Workers’ Comp Fraud

Employers can keep an eye out for some red flags in workers’ compensation claims. For example:

- Inconsistent details about the accident

- Unreported pre-existing conditions

- Social media activity showing physical activities that wouldn’t be possible with the claimed illness or injury

- Significant delay in reporting the injury

- Refusal to cooperate with medical exams or treatment

- Unclear medical records, such as signatures that don’t match or signs of Photoshop

- A lack of witnesses to corroborate the injured worker’s report (such as fellow employees, medical providers, and/or family members)

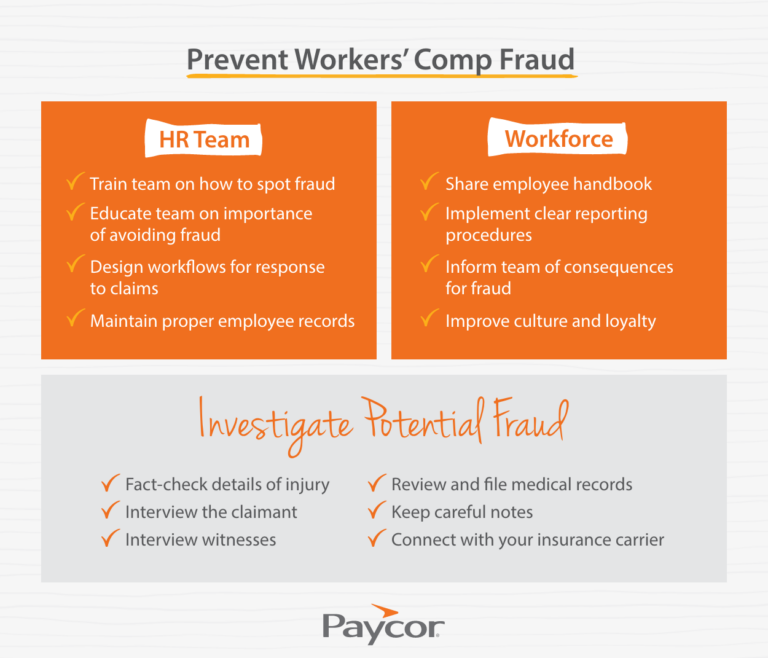

Steps to Prevent Workers’ Comp Fraud

The best way for HR to prevent workers’ compensation fraud is by having clear workflows in place. Within your department, make sure everyone is on the same page, knows how to recognize fraudulent workers’ compensation claims, and understands why they matter. Maintain accurate and up-to-date employee records. Write a clear and fair employee handbook, share changes with your team in a timely manner, and have employees acknowledge receipt of each updated version.

Outside of HR, implement clear reporting procedures for workplace injuries. Make sure every employee knows which forms to fill out, how to submit them, and who they should contact with questions about workers’ comp. You can also let them know about any consequences for fraudulent workers’ compensation claims.

If you receive a suspicious claim, conduct a thorough investigation. Fact-check all the details, including what caused the illness or injury, when it happened, and who saw the event or the aftermath. Keep a paper trail of all the information you collect – including notes on conversations you have with the employee or witnesses. Share your findings with your workers’ comp insurance carrier.

Consequences of Workers’ Comp Fraud

Workers’ compensation fraud is a serious crime. Employees or medical providers who falsify these claims can face criminal charges, fines, and even jail time. The consequences may be more severe depending on your state, the amount of the claim, and the details that were originally falsified.

How Paycor Helps

The first step toward preventing fraud of any kind – including workers’ comp fraud – is clear recordkeeping. Paycor’s HCM software empowers HR leaders to track every detail, from payroll to scheduling, on one integrated platform. You can also go beyond compliance with tools like Talent Development, which help you engage employees and cement their long-term loyalty. If your team is emotionally invested in the company, they’re less likely to lie about injuries.

Use Paycor’s resources to stay compliant and avoid workers’ comp fraud.