The gig economy has seen tremendous growth in recent years, accelerated by post-COVID shifts in work dynamics. According to Statista, the number of freelance workers in the U.S. has grown steadily year over year since 2017, reaching 76.4 million people in 2024. Business Research Insights show the global gig economy market size is $556.7, and expected to reach $1,847 billion in 2032 — a compound annual growth rate of 16.18%. This rise, fueled by advancing technology and demand for flexible work arrangements, has made managing gig workers a priority for organizations adapting to this new normal.

Read on for insight into common gig work jobs, the pros and cons of managing gig economy workers, and best practices for managing gig workers.

What is a Gig Worker?

First off, what does gig worker mean? A gig worker is a freelancer who takes on short-term, flexible jobs in addition to or rather than working in traditional, full-time employment. Gig work gained popularity with the rise of digital platforms like Uber, Fiverr, and DoorDash, which connect workers to on-demand opportunities.

Many people choose gig work for the flexibility to set their own schedules, pursue multiple income streams, or balance personal priorities. Unlike full-time W2 employees, gig workers often forgo benefits like health insurance or paid time off in exchange for autonomy and control over their work. This make hiring gig workers an attractive option for companies who need part-time or temporary help.

Common Gig Work Jobs

The gig economy may have risen in popularity through platform apps, but gig work has expanded to many different industries, driven by its flexibility and scalability. Certain job types naturally lend themselves to gig work because they require short-term commitments, can be performed remotely, or involve tasks that are project-based. However, the gig worker community continues to grow as more individuals and businesses see the benefits of this model.

Common gig jobs include:

- Rideshare drivers: Through platforms like Uber and Lyft, individuals provide on-demand transportation.

- Delivery couriers: Apps such as DoorDash and Instacart connect gig workers with food, grocery, and package delivery tasks.

- Content creators: Writers often take short-term contracts to produce blog posts or other copywriting tasks for companies.

- Graphic designers: Gig workers in design handle projects ranging from logos to full-scale branding, offering creative solutions to businesses.

- Handymen: Through services like TaskRabbit, workers complete physical tasks such as furniture assembly, repairs, and moving assistance.

Pros and Cons of Hiring Gig Workers

Considering hiring gig workers for your company. Advantages and disadvantages to hiring gig workers include the following:

Pros

The primary benefit of hiring gig workers is flexibility. Businesses can scale their workforce up or down as needed without long-term commitments, making it ideal for seasonal work, short-term projects, or fluctuating demand. Gig workers also bring specialized skills, allowing companies to access expertise on a per-project basis without the costs of full-time employment, such as benefits or payroll taxes. This cost-effective model helps organizations stay agile and competitive.

Cons

Despite the advantages, relying on gig workers can present challenges. Gig workers may lack the same level of loyalty, accountability, or long-term commitment as full-time employees, which can impact continuity and team cohesion. Additionally, businesses face legal risks if worker classifications are unclear. It’s crucial to know the difference between employees and independent contractors. Balancing gig workers with core staff requires careful planning to ensure productivity and alignment with company culture.

How to Hire Gig Workers

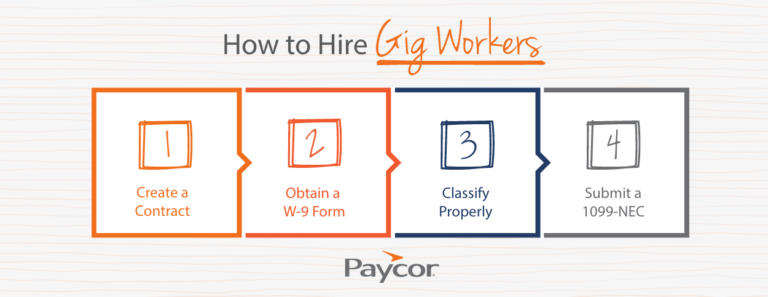

Follow these steps to legally hire gig workers:

- Create a contract: Draft a written agreement that details payment terms, project expectations, and ownership of work. This protects both parties and establishes clear boundaries.

- Obtain a W-9 form: Request a completed W-9 form from the gig worker for tax reporting purposes.

- Classify properly: Ensure the gig worker controls their schedule, tools, and work methods to meet legal requirements for independent contractors.

- Submit a 1099-NEC: For workers paid $600 or more annually, issue a 1099 form to report earnings to the IRS.

Hiring gig workers allows businesses to access affordable, flexible, and specialized talent. Following these steps ensures a smooth, compliant process that benefits both the company and the worker.

Best Practices for Managing Gig Workers

It’s important to understand how to manage gig workers to ensure you’re giving direction and deadlines while still allowing them to manage their tasks independently. Unlike full-time staff, gig workers are typically engaged for specific projects, have more flexible work arrangements, and operate with greater autonomy. This means developing strategies that maximize productivity while respecting their independent status and maintaining clear, professional communication. Companies must be intentional about creating engagement models that align with the gig economy’s dynamic and project-based nature.

1. Clearly Communicate Expectations

Setting clear expectations helps gig workers deliver quality results without excessive oversight. This includes defining project goals, deliverables, deadlines, and communication preferences upfront. For example, if you’re hiring a freelance designer, outline the timeline for drafts, revisions, and the final product, ensuring both parties agree on the scope of work. Tools like project management software can streamline this process by keeping tasks organized and providing visibility for all stakeholders.

2. Offer Onboarding

Proper onboarding is still important for freelancers — maybe even more so, as they won’t have coworkers to lean on for institutional knowledge. A well-designed onboarding process helps gig workers quickly understand your company’s culture, project goals, and specific workflow requirements. This might involve creating concise video tutorials, providing detailed written guidelines, or offering quick orientation sessions that rapidly bring contractors up to speed.

3. Make Payments on Time

Timely payments build trust and maintain positive relationships with gig workers, encouraging them to prioritize your projects. Use automated payment solutions to ensure accuracy, payroll compliance, and efficiency, making it easier to process invoices and pay 1099 employees.

4. Offer Regular Feedback

Unlike traditional employees, gig workers often have limited opportunities for direct interaction and professional development, making targeted, specific feedback crucial for their ongoing improvement and engagement. Provide constructive feedback during and after a project to help gig workers improve and feel supported. Regular communication ensures the work stays on track and helps build a positive working relationship.

How to Pay a Gig Worker

Paying freelancers differs significantly from compensating regular employees, requiring careful attention to financial and legal guidelines. Unlike W-2 employees, gig workers receive their full contracted rate without income tax, Social Security, or Medicare deductions. The contractor is responsible for reporting the pay to tax authorities, as well paying the appropriate taxes (12.4% for Old-Age, Survivors, and Disability Insurance).

The payment process typically involves establishing clear terms in a contract that specifies rate, payment schedule, and method of compensation, whether that’s hourly, per project, or milestone-based. Maintain detailed records of all payments and issue a 1099-NEC form for any contractor paid $600 or more in a calendar year to ensure compliance with IRS reporting requirements.

How to Fire a Gig Worker

Ending a working relationship with a freelancer doesn’t require as formal a process as parting ways with W2 employees. You aren’t necessarily firing them; you’re terminating a contract. For a contract with an end date, you can simply choose not to renew the contract and part ways.

If for some reason you need to end a contract before the agreed-upon date, ensure you review the contract and follow any termination provisions. Compensate the worker for any work already completed that meets the original contract specifications.

How Paycor Helps

Whether you manage W2 employees, 1099 workers, or both, Paycor’s workforce management solution simplifies the process and helps ensure compliance with labor laws and tax regulations. Learn why 30,000+ companies trust Paycor with their workforce management and payroll processing needs. Check out our workforce management bundle to get started.