Starting in 2024, all LLCs in the USA must file a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN). This requirement is part of the Corporate Transparency Act (CTA) passed in 2021. The CTA mandates that all reporting companies, including LLCs of all sizes, submit BOI reports unless they qualify for an exemption.

The deadline is soon approaching for companies to comply with this law. If your company was created or registered prior to January 1, 2024, you have until January 1, 2025 to report BOI. Companies created or registered in 2024 have 90 calendar days to report BOI. Companies created or registered after January 1, 2025, must submit BOI within 30 days. It’s important to note that this applies to the date of registration, not necessarily when the business first started operating.

Want to know more about BOI reporting, also known as BOIR, requirements? Read on for everything you need to know about BOI’s purpose, filing process, and more.

What is Beneficial Ownership Information?

Beneficial ownership information (BOI) is identifying information about the individuals who own or control a company. By requiring owners to report the information, the U.S. government intends to make it harder for bad actors to utilize shell companies or unclear ownership structures to hide gains.

A beneficial owner is an individual who directly or indirectly exercises substantial control over the company, owns or controls at least 25% of the ownership interests, or has a right to receive at least 25% of the company’s profits. This typically includes owners, senior officers, and directors. For small businesses with a single owner-operator, they would be the sole reporting person. In larger corporations, this could include a board of directors and major shareholders.

HR plays an important role in identifying and gathering the necessary information about beneficial owners from employees who hold these roles. They may need to coordinate with various departments to ensure all required individuals are accounted for.

The corporation and LLC ownership reporting requirement stems from the Corporate Transparency Act, which was passed on a bipartisan basis in 2021. This law aims to prevent money laundering, the financing of terrorism, and other illicit activities by increasing transparency into who ultimately benefits from a company’s existence.

Who Needs to File a BOI Report?

Companies that are required to report BOI include:

- Domestic corporations, limited liability companies, and any other entities created via the filing of incorporation documents with a secretary of state or similar office in the U.S.

- Entities (including corporations and LLCs) formed under the law of a foreign company that are registered to conduct business in the U.S. per a filing with a secretary of state or similar office

Any company required to file a BOI report is referred to as a reporting company. There are some exemptions, including:

- Securities reporting issuer

- Governmental authority

- Bank or credit union

- Insurance company

- Accounting firm

- Public utility

- Venture capital fund advisor

How to File a BOI Report

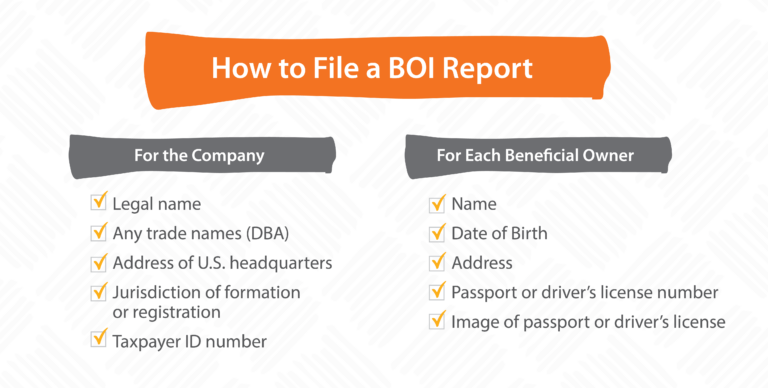

Reporters can file their BOIR on the FinCEN website via an online form or through downloading and filling out a PDF. The form asks for basic identifying information of the company and its owners.

For the company, be prepared to fill out:

- Its legal name

- Any trade names (doing business as or trading as)

- Address of U.S. headquarters

- Jurisdiction of formation or registration

- Taxpayer Identification Number

A beneficial owner refers to an individual who either directly or indirectly exercises control over the company or owns at least 25% of the company’s ownership interests, such as equity shares, stock, or voting rights. Beneficial owners must be people, not trusts or corporations. There’s no maximum number of beneficial owners, and each should be listed.

For each beneficial owner, be prepared to fill out:

- Individual’s name

- Date of birth

- Address

- Identifying number from an acceptable identification document such as a passport or U.S. driver’s license, and the name of its issuing state or jurisdiction

- Image of the identifying document used

How Often Does a BOI Report Need to be Updated?

There are no ongoing reporting requirements. Once you file an initial BOI report, you’ve met your obligation unless you need to file an update or correction. Changes that would require an update to a BOI report include:

- Any reporting company changes, such as registering a new business name

- Beneficial owner shifts, such as a new CEO, or a sale that changes who meets the ownership interest threshold of 25%

- Changes to a beneficial owner’s name, address, or unique identifying number previously provided to FinCEN

All updates should be filed within 30 days of a change occurring.

Are there Penalties for Non-Compliance with BOI Reporting Requirements?

The Corporate Transparency Act states a person who willfully violates the BOI reporting requirements may be subject to civil penalties of up to $500 for each day the violation continues. This civil penalty amount is adjusted annually for inflation and is currently $591. Additionally, individuals may face criminal penalties for willful violations, including up to two years of imprisonment and fines of up to $10,000.

Violations include:

- Willfully failing to file BOI

- Willfully filing false BOI

- Willfully failing to correct or update previously reported BOI

Frequently Asked Questions

Need quick answers to your questions about beneficial ownership information reporting? Read on below.

When is my BOI Report Due?

If your company was created or registered prior to January 1, 2024, you must file a BOI form by January 1, 2025 to report BOI. Companies created or registered in 2024 have 90 calendar days to report BOI. Companies created or registered after January 1, 2025, must submit BOI within 30 days.

Who is Considered a Beneficial Owner?

A beneficial owner is any individual who either directly or indirectly holds at least 25% of a company’s ownership interests or has significant control over the company. Beneficial ownership can include interests like equity shares, stock, or voting rights.

What is the Purpose of BOI Reporting?

BOI reporting aims to increase transparency in company ownership, making it harder for individuals to use shell companies or complex ownership structures to hide illicit activities or financial gains. It helps the government identify the individuals who actually control or benefit from a company.

Who Can File BOI for a Reporting Company?

A reporting company can authorize anyone to file its BOI report, whether it’s an human resource employee, owner, or an external service provider. When filing, the individual must provide their own basic contact details, such as their name and email address. The person submitting the report, including any third-party service provider, must also certify on behalf of the company that the information provided is accurate, truthful, and complete.

What Are Acceptable Identification Documents for Owners?

When reporting BOI for individual owners, acceptable identification documents include:

- U.S. driver’s license

- Identification document issued by a U.S. state, local government, or Indian tribe

- U.S. passport

- Foreign passport (acceptable if person doesn’t have any of the above three documents)

Note: In order to be acceptable, these documents can’t be expired.

Is the Corporate Transparency Act Unconstitutional?

This was the basis of a lawsuit filed by 65,000 members of the National Small Business Association. A federal judge in Alabama ruled in favor of the plaintiffs and enjoined FinCEN from enforcing the BOI reporting requirement against the plaintiffs. FinCEN announced they will comply with the court’s order.

This ruling only impacts the companies that were a part of the lawsuit. As of now, reporting companies must meet BOIR deadlines or risk penalties.

How Paycor Helps

To avoid civil and criminal penalties, it’s critical to file BOI correctly and on time. In addition, any updates must be filed within 30 days of a change to company or ownership information. With a secure system of record like Paycor, valuable BOI information is always at your fingertips.

In addition, our compliance solutions help customers stay updated and informed on regulations, so you never miss a deadline. Take a guided tour today to learn why 30,000+ companies trust us as their dedicated HCM software solution.