Payroll Compliance Watchouts

From FLSA, EPA, Workers Comp and more, there are lots of federal laws to keep track of to ensure payroll is compliant. State and local taxes only add complexity. That’s why HR and business owners need to have processes in place to consistently apply pay policies, accurately calculate overtime and streamline leave policies. This is often streamlined with payroll services or payroll software, but if you don’t have the proper controls in place and your company is audited or sued, it can be difficult to provide accurate records and audit trails. The good news is that there are payroll resources that can help, starting with this list of common payroll errors to watch out for.

Here are four common Payroll errors you might be making:

- Misclassifying Freelancers and Employees

If some of your full-time employees are misclassified as independent contractors and don’t receive their benefits, your company could be in hot water. Misclassifications often result in a shortage of overtime wages, which can result in major penalties and lawsuits. - Disregarding Pay Equity

The EPA (The Equal Pay Act) and many mandates in specific states dictate that men and women receive equal pay for equal work. If a wage inequality between men and women is discovered, you cannot reduce the wages of either party to equalize pay. - Workers’ Compensation Insurance

Every state has a unique Worker’s Compensation program to provide compensation to employees who are injured on the job. It’s important to keep up-to-date on any changes, especially if you have offices in multiple locations. - Federal & State Payroll Taxes

Payroll tax is one of the most regulated parts of running a business. You’re responsible for meeting federal, state and local tax requirements which includes paying and reporting employer and employee payroll taxes.

Misclassifying Freelancers and Employees

Fair Labor Standards Act (FLSA)

The FLSA, the federal law that mandates a minimum wage and overtime pay, only applies to employees and not contractors, which is an important distinction.

If an employer misclassifies workers as FLSA exempt, it’s likely by accident. Regardless of intent, if overtime wages aren’t paid employers may be in danger of lawsuits and penalties.

The Gig Economy is Affecting Compliance

Employers are working with independent contractors and interns more than ever. But as you may know, gig workers aren’t entitled to benefits such as overtime pay and minimum wage. If your employers aren’t properly classified, they could miss out on benefits, and that could put your organization in hot water.

Here’s a breakdown of the most common FLSA violations:

How to Classify Employees & Independent Contractors

Classifying employees and independent contractors is a distinction made by the IRS, which reviews at the business relationship your company has with a worker to determine whether they’re an employee or not.

Here are the 3 categories the IRS considers when classifying workers:

- Behavioral Control

- Financial Control

- Type of Relationship

Difference Between Employees & Independent Contractors:

| Behavioral Control | Financial Control | Type of Relationship | |

|---|---|---|---|

| Employee | On-the-job training. Set hours and guidelines for work to be completed. | Guaranteed wages or salary. | Receives employee benefits (e.g., PTO, insurance, pension plans, etc.) |

| Independent Contractor | Sets their own hours. Decides how the project should be completed. | Paid a flat fee per project or hour. | Contracted for a set time or number of projects. |

Need help determining the classification of an employee?

For an official determination you’ll need to file Form SS-8 with the IRS.

Disregarding Pay Equity

Equal Pay for Equal Work: Not as Easy as it Sounds

The EPA seems straightforward: women and men in the same workplace must receive equal pay for equal work. To qualify for equal pay, the jobs don’t have to be exactly the same, but they do have to be significantly similar.

Salary isn’t the only form of compensation covered by the EPA. Overtime, benefits, vacation pay, travel reimbursements and bonuses are all protected. Keep in mind, if the EPA determines there’s a wage inequality, you can’t reduce the wages of either party to equalize pay.

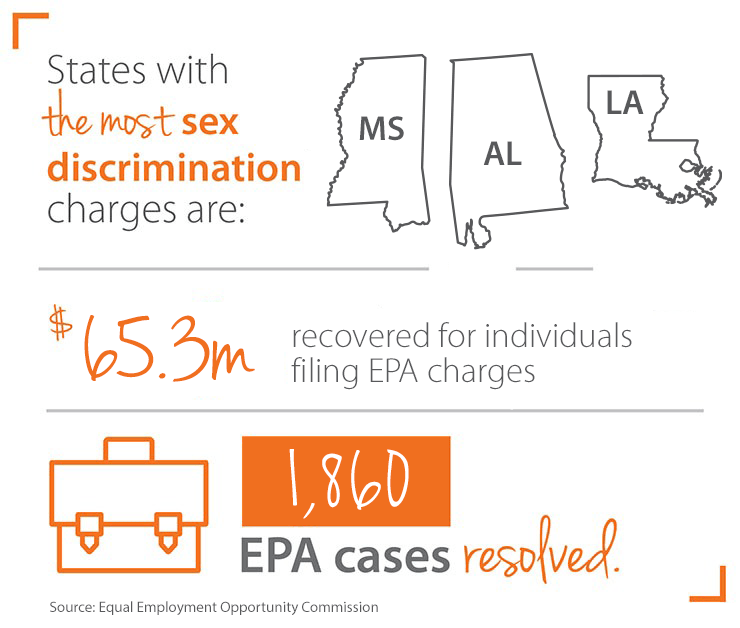

The top 3 states with the most sex discrimination cases were Alabama, Mississippi and Louisiana. A total of 1,860 people have been assisted by the EPA. In the past five years, the EEOC has recovered $65.3 million for individuals filing EPA charges.

Source: https://www.eeoc.gov/continuing-impact-pay-discrimination-united-states

It’s Been a Long Road Since 1963

Title VII of the Civil Rights Act of 1964 and the Equal Pay Act of 1963 prohibited pay discrimination based on gender. But today, 42 states have gone above and beyond the federal law to safeguard women in the workforce.

Not All States’ Pay Parity Laws are Created Equal

While Massachusetts, California and New York have pushed to protect equal pay, states like Florida, North Carolina and Alabama have close to nothing on the books.

Where does your state stand on pay equity? The answer may surprise you.

How to Pay Women and Men the Same

If Phil Knight was here, he’d say, “just do it”. But often, discovering pay discrepancies isn’t that simple. With today’s HR & payroll technology, some providers offer pay equity dashboards, allowing you to easily identify pay discrepancies by individual, department, location and more.

How to Discover Pay Discrepancies and Fix Them (On Your Own)

Let’s say you haven’t made the investment in technology and you’re not looking to any time soon. How can you identify problem areas on your own and equalize the pay?

Check out these 3 pay discrepancy tips:

- Analyze Your Pay Structure

- Step 1. Average the pay (on a weekly, biweekly, monthly or hourly basis) for all women and men based on job content.

- Step 2: Compare the stats! Do all the women fall below the average while men rise above it? (If you don’t have another explanation for the differences like seniority, education, experience, etc., you may need to consider equalizing the pay.

- Review Job Descriptions

- Step 1: Identify what the job entails.

- Step 2: Record the types of working conditions the jobs are performed under.

- Step 3: List out what skills and effort is required to do the job.

- Know the Legal Pay Discrepancies

- Seniority

- Quantity or quality of work

- Experience

- Training

- Working conditions

- Additional job duties and skills required

- Shift differentials

- Ignoring Workers’ Compensation Insurance

What is Workers’ Compensation Insurance?

Workers’ compensation insurance provides lost wages, rehabilitations costs and medical expenses to employees that are injured or become sick at work. If a worker is killed on the job, workers’ compensation also pays death benefits to the related families.

Is workers’ comp an “exclusive remedy”?

According to regulators, since employees agree not to file lawsuits but instead to receive payment for job-related injuries, workers’ compensation is considered an exclusive remedy.

Is Negligence to Blame?

If an employer chooses to ignore workers’ compensation insurance, employees can file suits. But you should never take the risk. Unless regulators determine negligence is at play, insurance will keep you from being held personally liable for the accident. (And just to drive home the point: employers who choose to ignore workers’ comp will face stiff penalties and potential criminal charges.)

Most expensive Workers’ Compensation accidents:

- Motor Vehicle $ 81,971

- Burn $ 58,284

- Fall/Slip $ 47,681

- Caught by $ 45,255

- Struck by $39,509

How to Create an Injury and Illness Prevention Program (IIPP)

First things first, IIPPs aren’t a one-size-fits-all plan. Your program should be tailored to your industry and your business.

Here’s 3 tips to get started on an IIPP:

- Identify your existing practices – By auditing your own practices you’ll discover areas where safety practices are lacking. This will give you a starting point for developing your IIPP.

- Assess crew sizes, work shift length and working conditions – It’s important to document conditions like average temperatures to see pre-existing red flags that may cause injuries or illnesses.

- Explore Sample Models from OSHA – Save yourself time and research sample models from OSHA and DOSH. These models outline key IIPP elements, including:

- Compliance

- Responsibility

- Training

- Instruction

- Hazard correction

- Record keeping

Miscalculating Federal & State Payroll Taxes

State and federal taxes include:

Federal Unemployment Taxes

This is a tax based on the gross pay of employees, documented on Form 940. Payments can be made annually or quarterly.

Federal and State Income Taxes

Form 941 (Employer’s Quarterly Federal Tax Return) requires employers to report income and employment taxes withheld from their employees and deposit the funds to a bank, according to the Federal Tax Deposit Requirements.

FICA Taxes

Otherwise known as Social Security and Medicare taxes, these taxes are withheld from employee pay AND matched by employers. Depending on the size of your company, FICA taxes get paid once or twice a month. FICA taxes are reported quarterly on Form 941.

What Happens if You Have Unpaid Payroll Taxes?

It’s simple, if you fail to pay payroll taxes, you’ll be penalized. Specifically, you’ll be fined a percentage of your gross payroll deposit based on the number of days your deposit is late.

| Days Late | Penalty: |

|---|---|

| 1-5 days | 2% |

| 6-15 days | 5% |

| 16 days or more | 10% |

| Amounts unpaid more than 10 days after the date of the first IRS notice requesting the tax, or the day when you received notice and demand for immediate payment, whichever is earlier. | 15% |

3 Tips to Mitigate Risk

- Ensure your budget accounts for tax payments.

You may be shaking your head, but it’s common for organizations to overlook taxes. This is a quick simple fix that can prevent a lot of headaches. - Audit your current payroll provider.

It’s not always about technology, it’s about the right combination of technology PLUS expertise. Find a provider with a dedicated team of tax experts who can help you remain compliant with federal and state taxes. Want to see what the right partner has to offer? - Stay up-to-date with IRS announcements & resources.

The IRS is constantly publishing news releases, tax law updates, tax tips and form deadlines.

Where Do Employer and Employee Taxes Go?

| Employer | Employee | Total | Income Cap | What They Pay For | |

|---|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4% | $142,800 | 85 cents of every dollar goes into an account that pays benefits to retirees and surviving spouses and children of employees who have died. The other 15 cents is put into an account that pays benefits to people with disabilities. |

| Medicare | 1.45% | 1.45% | 2.9% | No Limit* | Goes into an account that pays for some healthcare costs for Medicare recipients. |

| State Unemployment | Variable | None | Variable | Variable | Paid to participating state workforce agencies to pay unemployment benefits. State laws determine these tax rates. |

| Federal Unemployment | 6.0% | None | 6.0% | $7000 | Covers the cost of managing the Unemployment Insurance and Job Service programs in every state. |

*Wages of more than $200,000 earned in 2022 will be taxed an additional 0.9%

Is it Time to Switch Payroll Providers?

Technology alone isn’t enough. You need technology plus expertise to keep your payroll processes compliant. And you need ongoing support, not impersonal, 1-800 number call centers. To succeed, you need a dedicated team of payroll and tax experts that not only understands HR software, but are intimately familiar with your business. Are your ears perking up? Click here to learn more.

If Your Current Payroll Provider Isn’t Doing These 8 Things… Run.

- User Experience

Your HR and payroll solutions should always have the customer top of mind. It should have mobile functionality to streamline processes for employers and employees while offering seamless integrations with other HR tools. - Integration

Your provider should offer one single source of truth for all employee data. You should never have to switch platforms, log-in to multiple systems, re-key information or open multiple spreadsheets. - Employee Self-Service

To eliminate administrative tasks, your solutions should offer employee self-service. Workers should have full visibility into their pay stubs, update personal information and manage PTO without HR’s help. - Tax-Filing Services

You don’t just need payroll, you need payroll that can handle the complexities of your local tax environment and multiple fed IDs. Some HR providers go above and beyond and offer access to teams of dedicated tax experts to help you remain complaint. When you’re evaluating providers, make sure to bring this up. - Reporting

If your payroll provider can’t quickly generate the reports you need, you should consider looking for a new solution. Look for a payroll software system that stores data on the cloud. This will make accessing reports simple and save space on your company servers. - Compliance Management

As you know, HR compliance is so much more than paying taxes. There’s minimum wage, overtime laws, misclassifying employees, workers’ compensation and more. To ensure compliance, you need to be able to immediately access all employee data and documentation. Ask your HR & Payroll provider what they’re doing to mitigate risk for your organization. - Security

Your organization houses a lot of sensitive information about your employees. If this data were to ever get in the wrong hands, it could be devastating for your business. Since your payroll database is a prime target for hackers, you need to have a secure data system. Before you partner with an HR & payroll provider, ask them what security measures they’ll put in place. They should offer multi-factor authentication, access to a risk assessment team and data encryption. - Service After the Sale

Customer service should be one of your top concerns. Technology can only help so much. When you have questions or issues, there’s nothing worse than impersonal 1-800 call centers. Here are a few questions you should ask while evaluating providers:- Do I have access to a dedicated service representative?

- Can I talk to a representative immediately?

- How long does it usually take to get a response?

- Has your company received any customer service awards