Keep Track of Pay Periods and Paydays in 2025

Need to access a previous year calendar?

2024 Payroll Calendar (PDF)

2023 Payroll Calendar (PDF)

2022 Payroll Calendar (PDF)

You don’t need us to tell you that a business can’t run without payroll. Workers contribute their valuable time in exchange for a consistent paycheck. Even though it often appears seamless to employees, payroll management requires a lot of attention to detail. There are state and federal taxes to consider, vacation time, holidays, direct deposits, overtime calculations, payroll records, and more.

Many businesses use HR software to streamline the payroll process and prevent errors, For those who don’t, manual payroll processing can take hours. It’s no wonder 70% of HR teams waste time on manual processes (Paycor). If you’re tired of spending time on manual payroll, Paycor can help.

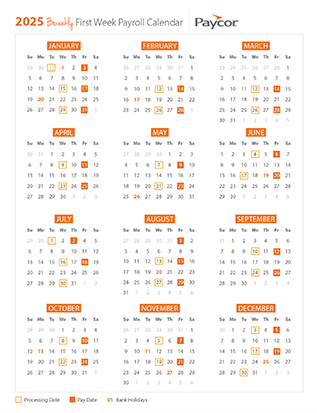

We’re providing these payroll calendar templates to help you keep track of pay periods and paydays. It may seem simple, but tools and resources like these 2025 Payroll Calendar Templates make a world of difference for HR teams.

How to Use this Payroll Calendar Template

These free, downloadable payroll calendar templates provide examples of common payroll processing days and paydays. If these dates align with your schedule, use these calendars to stay on track or share them with employees so they know when they’ll get paid.

| Pay Check # | Biweekly Pay Date (First and Third Friday) | Biweekly Pay Date (Second and Fourth Friday) | Semi-Monthly Pay Dates | Monthly Pay Dates (Last Friday) |

|---|---|---|---|---|

| 1 | 1/3/2025 | 1/10/2025 | 1/15/2025 | 1/31/2025 |

| 2 | 1/17/2025 | 1/24/2025 | 1/31/2025 | 2/28/2025 |

| 3 | 1/31/2025 | 2/7/2025 | 2/14/2025 | 3/31/2025 |

Biweekly pay periods

Every business has its own rationale for paying employees when they do. While pay periods are mandated in some states, some employers can choose a frequency based on their cash flow or other business needs. Pay periods are commonly weekly, biweekly, semi-monthly, or monthly. Biweekly pay periods are the most common, with 43% of private U.S. businesses paying employees this way (Bureau of Labor Statistics).

How many biweekly pay periods are there in 2025?

In 2025, if you will be managing a traditional biweekly pay schedule, employees who are paid biweekly will receive 26 paychecks. Employees will receive two paychecks in 10 of the 12 months and three in two of the months.

If the first January paycheck runs on January 3rd, then there will be three paychecks distributed in January and July. If the first January paycheck is distributed on January 10, a third paycheck will be distributed in April and October.

What are semi-monthly pay periods?

If your business uses semi-monthly pay periods, you’ll have two pay periods per month, usually ending on the 15th and the 30th.

HR Pro Tip: Aren’t semi-monthly and biweekly the same? Sort of, but not really. In a biweekly schedule, employees get paid every other week, which sometimes means they get paid three times in one month. In a semi-monthly schedule, they get paid twice each month, no matter what.

What is a monthly pay period?

In a monthly pay period schedule, employees receive 12 paychecks per year, or one per month, usually on the last day of the month.

Read our article: Pay Frequency Requirements by State

Why is it important to keep accurate payroll information?

Keeping accurate payroll records is required by federal law. And if your payroll process isn’t compliant, it can cost your business hefty fees in fines and litigation. When managing payroll information, you not only need to consider state and federal taxes, but also Family and Medical Leave Act (FMLA) policies, the Fair Labor Standards Act (FLSA), and other local and federal laws.

How Paycor Helps

Paycor’s payroll software is an easy-to-use yet powerful tool that saves HR time and money. When you automate your payroll processes and get help with complicated issues like payroll tax compliance and workers’ comp, you can spend more time on strategic decision-making. Contact us today to learn more about how our expert payroll processing and tax solutions can help you pay employees on time and avoid compliance missteps.