Secure Act 2.0

What You Need to Know: SECURE Act 2.0

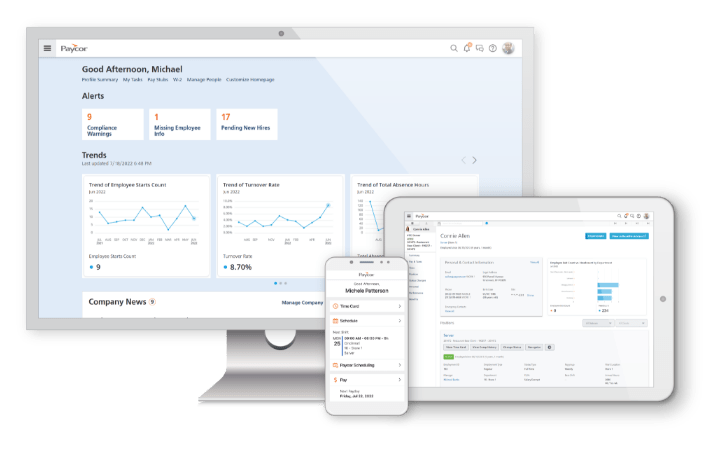

With a goal of improving Americans’ financial preparedness for retirement, the Secure Act 2.0 introduces mandatory guidelines that you and your clients must follow, with a focus on integrating 401(k) offerings with payroll processes. Paycor can help. Our extensive range of powerful integration partners gives you the freedom to choose the solutions that work best for your clients and ensure compliance with the new retirement rules.

Access a network of 360-degree integration partners that support your clients’ needs and keeps them compliant.

Get streamlined plan administration by connecting data with your retirement partner of choice.

A core HR solution for all employee data—no need for rekeying info or multiple spreadsheets.

Eliminate manual updates, reduce admin time, and decrease the potential for costly errors.

Mandatory Regulations Impacting Payroll

A key aspect requires your clients to make their 401(k) offering integrated with their payroll process. It’s no longer a matter of convenience. This means your clients will most likely be auditing their retirement practices, evaluating their current payroll process, and coming to you with a list of questions to ensure their compliance. The requirements are:

Automatic Enrollment (Effective 1/1/2025)

- Businesses adopting new 401(k) or 403(b) plans must enroll employees automatically.

- Employees will be enrolled at a contribution rate of at least 3%.

Increase in Catch-Up Contribution

- Participants ages 60-63 can make catch-up contributions up to $10,000 annually to a workplace plan which will be indexed to inflation. (Effective 1/1/2025)

- Catch-up contributions must be directed to Roth accounts for participants with income over $145,000 in the prior year. (Postponed to 2026)

Long Term/Part Time Eligibility (Effective 12/31/2024)

- Long Term/Part Time (LTPT) employees who complete at least 500 hours in two consecutive plan years are eligible for the plan.

- Previously, eligibility required completing 500 hours in three consecutive plan years.

Optional Provisions for Your Clients

Not every aspect of the new law is mandatory. There are some elective choices your clients can make:

Student Loan Payments (Effective 12/31/2023)

- Starting in 2024, employers can match employee student loan payments by making matching payments to a retirement account.

Emergency Savings (Effective 12/31/2023)

- Defined contribution retirement plans can now include an emergency savings account, which is a designated Roth account.

- Employees can contribute up to 3% of their salary, with a maximum contribution of $2,500.

- They can make up to four withdrawals each plan year without any fees.

Roth Matches (Effective 1/1/2023)

- Participants have the option to designate employer matching or nonelective contributions to Roth accounts.

SECURE Act 2.0: Resources for You and Your Clients

As a trusted advisor, your clients rely on you to help keep them compliant. There will undoubtedly be questions surrounding the details and implementation of these new regulations. We’re committed to supporting you and your clients through this process. Check out our library of resources for more information and feel free to share with your team!

- On-demand webinar, The SECURE Act 2.0: What You Need to Know for Employer Retirement Plans, that details the key provisions of the new legislation and how it impacts employer-provided retirement savings plans.

- Downloadable PDF outlining the key provisions of the Secure Act 2.0

- Learn more about how Paycor helps businesses stay compliant with payroll and taxes.