Online Payroll Software

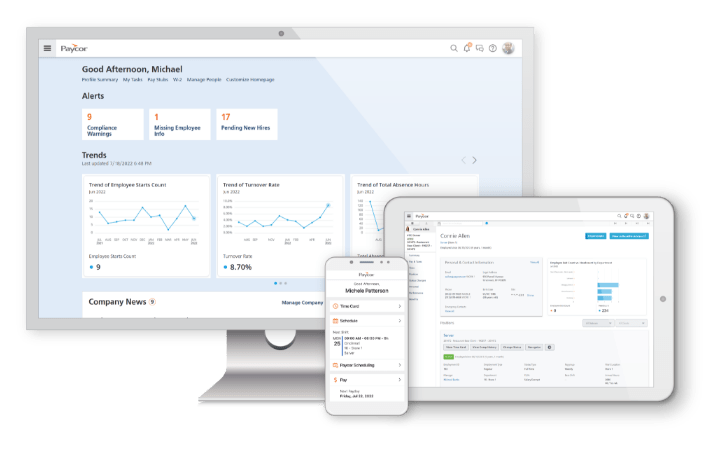

Streamline Payroll Anytime, Anywhere

Payroll software may look similar, but it’s not all created equal. Paycor’s Payroll is intuitive, flexible, and backed by solid tax and compliance expertise. Speak to a representative today, call 513-338-0399.

More than 50,000 businesses nationwide trust Paycor*

A Smarter, More Efficient Payroll Solution

Robust Features for Any Size Business

Transform the way you process payroll with a flexible, modern solution that saves time and gives you peace of mind.

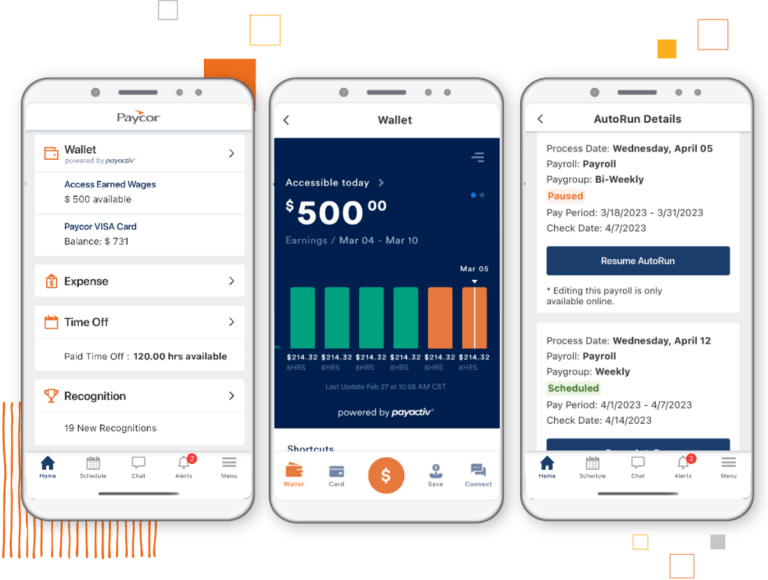

OnDemand Pay (EWA)

Attract more talent, improve retention, and boost productivity by giving your workforce timely access to money they’ve already earned prior to payday.

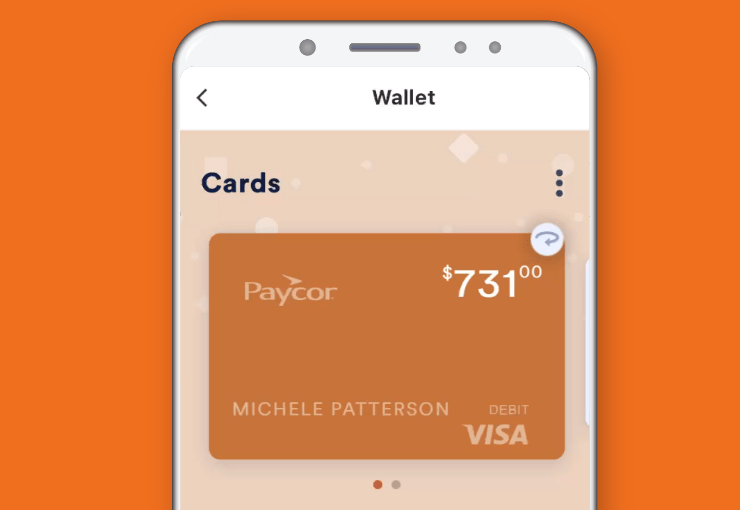

Paycor Mobile Wallet

One secure place for employees to access earned wages, pay card info, and financial wellness resources like budgeting tools, a discount marketplace, and direct bill pay.

AutoRun

Administrators enjoy the freedom of scheduling payroll to process on a specific day and time without having to log in.

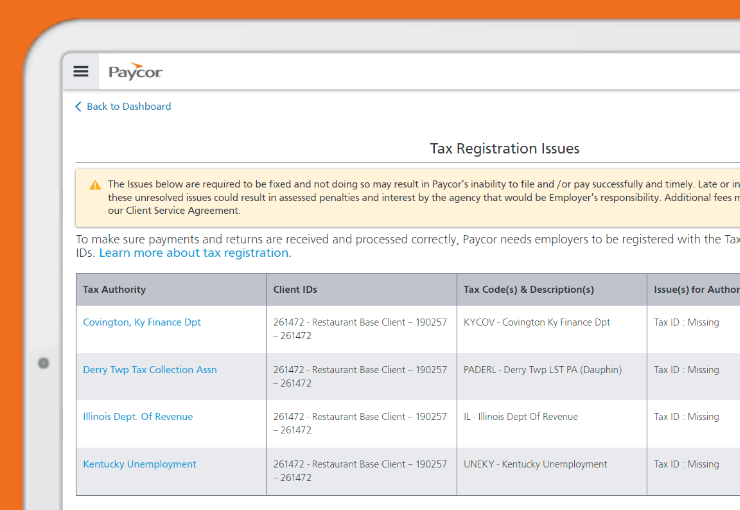

Stress-Free Tax Compliance

Regulations at the local, state, and federal levels are constantly evolving and chances are high that you don’t have extra time in your day to keep up. Proactive alerts and tax warnings help you stay ahead.

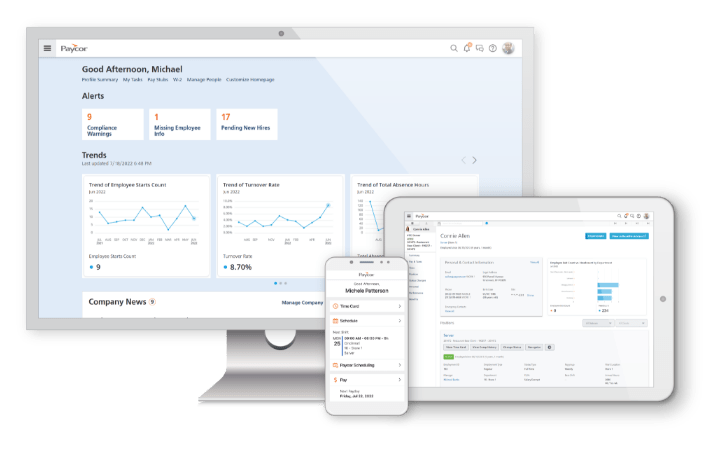

Compliance Dashboard

Get proactive alerts and compliance warnings directly on your Paycor homepage, including missing or invalid tax IDs, tax recommendations, and unverified or invalid addresses, and discrepancies in employees’ direct deposit information.

Tax Recommendations

Get tax setup guidance based on an employee’s work and home address, so you’re not left guessing.

Tax Processing

We handle the details, so you don’t have to, including tax filing, W-2, and 1099 processing.

Everything You Need,

All in One Place

Compliance Peace of Mind

No more Googling to check up on employment laws in your state or county. We provide in-product compliance updates and notify you of key changes.

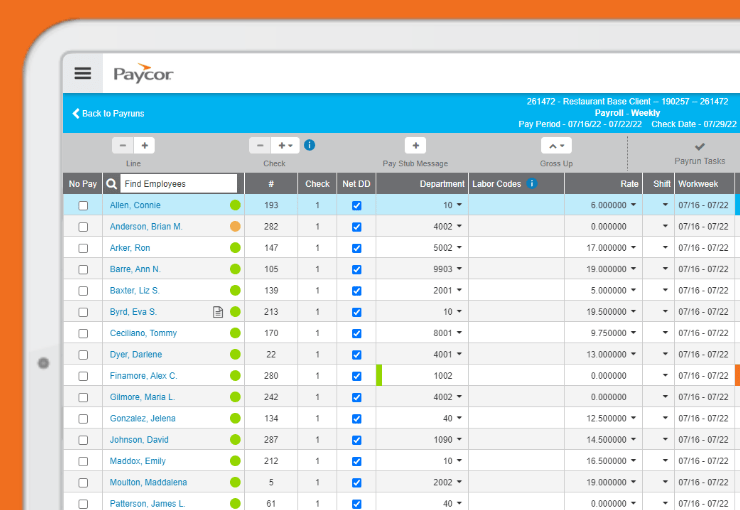

Real-Time Calculations

Say goodbye to batch processing. All payroll changes can be made in real time, no more waiting.

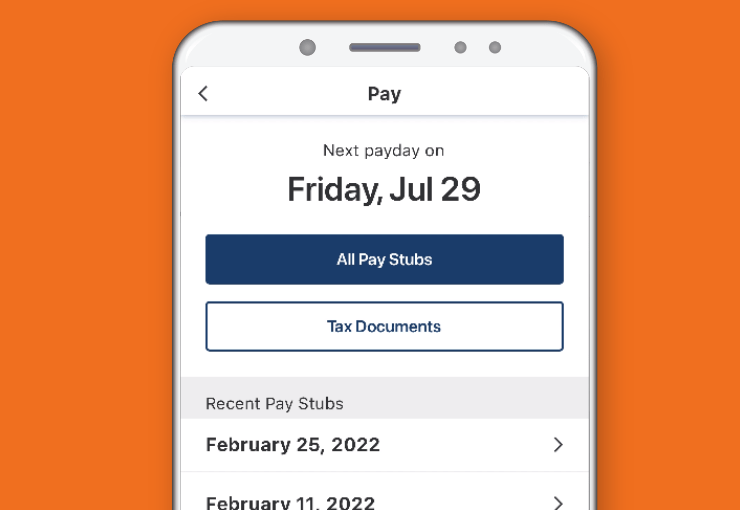

Paystub Preview

Avoid errors or last-minute changes by allowing employees to view their paystub up to three days before payday.

Direct Deposit

Say goodbye to paper checks. Employees receive paychecks directly into their bank accounts or funds can be automatically loaded to the Paycor Visa® Card.

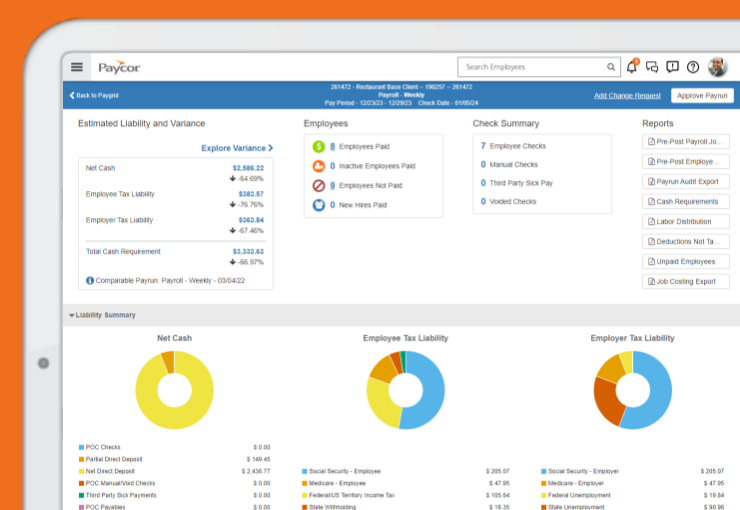

Payroll Reports

Get full transparency into cash requirements, tax liability, and a host of payroll reports.

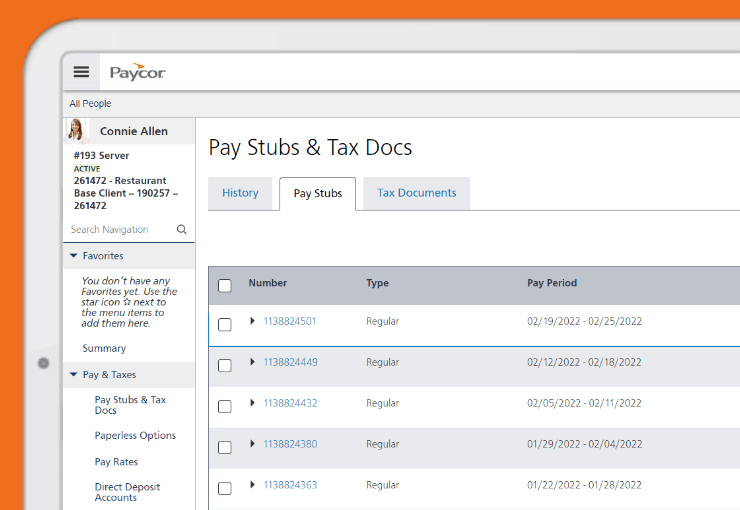

Employee Self-Service

Increase engagement by giving employees access to important information including pay stubs, W-2s and benefits elections, all through their mobile phones.

Workers’ Compensation

Avoid hefty down payments, earn interest, spread out your payments for improved budgeting and save time with automatic payroll deductions.

Wage Garnishments

We deduct employee garnishments from paychecks, so you don’t have to.

Customer Sandbox

Test configurations, security privileges, workflows, and train new team members in a secure environment without affecting your HR or payroll data.

Trusted By Users & Third-Party Evaluators

Ready to Learn More?

Hundreds of Apps & Tech Partners

We love to partner with the third-party apps your business currently uses. Explore our Marketplace to find the right fit.

Pay Solutions

Point of Sale

Benefits

Global Payroll

Advanced Scheduling

Background Screening

Tailored to Your Industry

The Paycor Difference

“I’m rarely at my desk. I am either in the control room or on the field; I’m always on my feet. Having that Paycor mobile app to manage my staff really empowers me to be a great leader.”

– Alex Schweppe, Game Entertainment Manager

Paycor Mobile

With a large contingent of seasonal employees, frontline managers depend on Paycor’s mobile app to help manage their team’s schedule and hours worked

Payroll & Tax Filing

With multiple pay groups and complex tax rules for players and personnel, the Bengals trust Paycor’s 30+ years of experience managing all aspects of payroll and tax filing.

Payroll FAQs

Payroll software collects employee hours worked data (for hourly workers) and salary data for full-time employees and consolidates it into an easy-to-read grid for payroll administrators to run on a regular basis. Through the software, administrators can choose the pay interval (weekly, bi-weekly, monthly, etc.), correct any mistakes and errors, and then do a pay run once all timecards have been approved. The system then pays employees according to their chosen payment receipt method.

Yes. Payroll software makes calculations based on the W4 information provided during your onboarding process. It also allows for unique local and state tax deductions. Paid time-off, workers compensation, and wage garnishments capabilities can all be included as part of your payroll software package.

Regular pay details for salaried employees can be manually entered in our system for reoccurring pay. For hourly wages, many customers purchase Paycor Payroll with our workforce management solution, Paycor Time, which allows you to collect employee hours through a physical time clock, iPad application, or mobile app. Our software integrates with other timekeeping systems as well, including point-of-sale (POS) systems.

We service organizations from 1 to 1,000+ employees. The sophistication and power of our payroll platform can be adjusted to the needs of your business as it grows. Our product tour is a good place to start to get an idea of what payroll and HR systems are recommended for your size business.

An online payroll system is a software system that administrators can use to process pay runs for their employees. It can be mobile or web-based and performs calculations for each employee based on tax location and withholding information. Online payroll helps administrators process payroll and pay employees through direct deposit, physical checks, or other means.

Payroll systems vary in price and complexity. When choosing a payroll provider, companies should look for a provider appropriate to the size of their business and their industry. Some companies prefer a white-glove service where most payroll tasks are performed for them, while others prefer to have an in-house payroll administrator who processes pay runs through a payroll software program.

It is important to run payroll reports for necessary documents like W2s, 940s, 941s and 944s. Payroll admins often run Cash Requirement, Pre-Post Payroll Journal, Payrun Audit, and Unpaid Employees reports to monitor labor costs and ensure compliance.

Employers must report wages, tips, and other compensation paid to employees by filling out required forms and submitting them to the IRS. Some federal forms that must be filled out are Forms 904, 941, 943, 944, and 945. Always seek the advice of a tax expert when completing federal, state, or local tax forms.

Featured Resources

The HR COE is an action plan based on Paycor’s proprietary data and research. Think of it as your roadmap to achieving HR excellence in talent management, workforce management, benefits and the employee experience.

Article

Read Time: 34 min

The Complete Guide to Payroll Services

Paycor’s comprehensive payroll services are designed to streamline your business operations. From accurate calculations to compliance management, we’ve got you covered.

Guides + White Papers

Read Time: 0 min

Why (and How) to Switch to a New HR & Payroll Platform

Sticking with the wrong HR & Payroll provider can tank an otherwise healthy business. See how switching platforms can make a positive impact.

Article

Read Time: 17 min

The Guide to Employee Timekeeping: Streamline Your Workforce Management

How you manage employee time directly affects your organization’s productivity. Learn about employee timekeeping to streamline your workforce management.

Live Webinar

5 Reasons to Build a Payroll & HR Integration

Did you know that you can embed payroll and HR software into your offering? Curious about the benefits of doing so? If you’ve been considering this, you’re not alone.

2:00pm ET, June 24th, 2025